An “Android for Wall Street” may be coming soon to an investment bank near you.

In the financial industry, where every edge to a firm’s trading or investment strategy is fiercely guarded, it’s no surprise that banks and wire houses have developed their own proprietary software and equipment that is best suited to their needs. The result of this is thousands of different applications, providing all manner of data, news and direct trading capabilities.

While different programs have overlapping features and there are industry standards—notably Bloomberg terminals or Thomson Reuters’ TRI, -0.03% Eikon—the proliferation of such applications has resulted in an environment that institutions see as inefficient. Different programs aren’t designed to work together, causing delays in an industry where the right price disappears in a microsecond, while compliance issues means that updates or fixes can be slow to come.

“When financial service software users interact with software, they’re usually doing it through a terminal, which is something that has no parallel in other industries, where people are increasingly interacting with everything through a browser,” said Matt Harris, a managing director at Bain Capital Ventures, who runs the firm’s financial services investments. “The status quo is very costly and it prevents firms from making the best-of-breed decisions.”

Read also: Experts link method of recent cyberattacks on banks to 2014 Sony hack

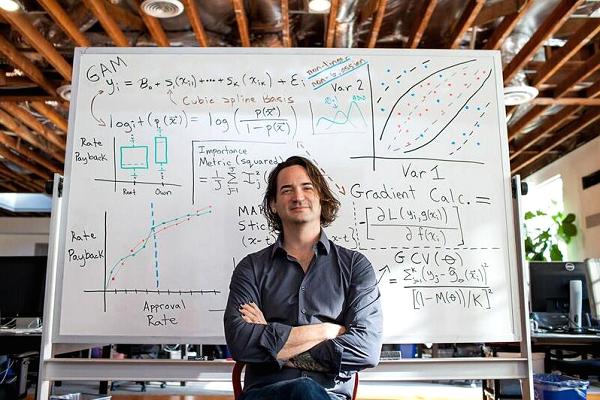

Looking to improve this issue is OpenFin, a New York-based financial technology company offering what it calls “the first common operating layer for financial desktop applications.” The firm’s Chief Executive and co-Founder Mazy Dar likens it to Android or iOS, the smartphone ecosystems where all users start from the same foundation, and where the different applications exist on it.

An “Android for Wall Street” may be coming soon to an investment bank near you.

In the financial industry, where every edge to a firm’s trading or investment strategy is fiercely guarded, it’s no surprise that banks and wire houses have developed their own proprietary software and equipment that is best suited to their needs. The result of this is thousands of different applications, providing all manner of data, news and direct trading capabilities.

While different programs have overlapping features and there are industry standards—notably Bloomberg terminals or Thomson Reuters’ TRI, -0.03% Eikon—the proliferation of such applications has resulted in an environment that institutions see as inefficient. Different programs aren’t designed to work together, causing delays in an industry where the right price disappears in a microsecond, while compliance issues means that updates or fixes can be slow to come.

“When financial service software users interact with software, they’re usually doing it through a terminal, which is something that has no parallel in other industries, where people are increasingly interacting with everything through a browser,” said Matt Harris, a managing director at Bain Capital Ventures, who runs the firm’s financial services investments. “The status quo is very costly and it prevents firms from making the best-of-breed decisions.”

Read also: Experts link method of recent cyberattacks on banks to 2014 Sony hack

Looking to improve this issue is OpenFin, a New York-based financial technology company offering what it calls “the first common operating layer for financial desktop applications.” The firm’s Chief Executive and co-Founder Mazy Dar likens it to Android or iOS, the smartphone ecosystems where all users start from the same foundation, and where the different applications exist on it.