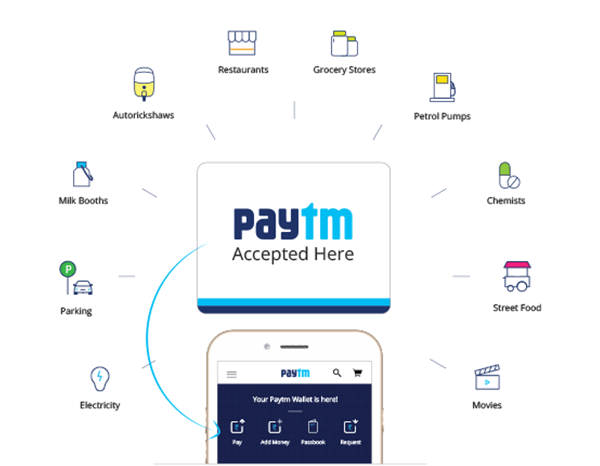

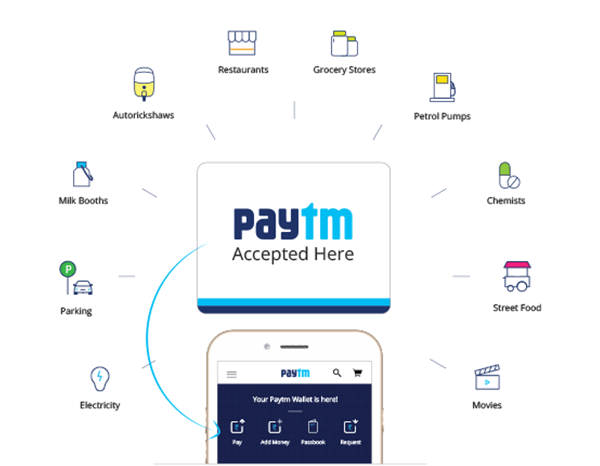

Paytm is one of India’s biggest online installment system that has made the entirety of our carries on with so a lot simpler. With the approach of web based shopping and the expanded pace of web entrance, it is simply consistent to have a proficient and dependable installment entryway. The organization works principally in Noida and has a client base that is spread over the globe. So, know about the Paytm shareholders. See this below.

Universally, the online installment market is worth around 44 billion USD and has a development pace of 17.6%. As the numbers show, the business is exceptionally encouraging and undoubtedly will turn into the widely utilized installment technique in the coming future. With regards to India, the piece of the pie is around 82,000 million USD with a CAGR of 18%.

About Paytm Company:

There are countless online installment gateways accessible in India and the majority of the clients have more than one installment application introduced in their cell phones. A portion of the significant contenders of Paytm is PayPal, Mobikwik, and Freecharge. It is an exceptionally serious industry and subsequently, the competitors are in steady exertion to beat one another.

At the point when we consider Paytm investors, the name of Vijay Shekhar Sharma, the originator of Paytm pops into our psyches. However, the Paytm investor’s rundown comprises of multibillionaire Alibaba, One97, Tata Sons, Softbank, Ant financials, etc. Paytm’s greatest investor is Alibaba itself. So this Indian organization’s biggest investor is a Chinees company! Paytm investors 2020, 2019 have huge variations. In the start, Paytm’s principal investor used to be One97, however with the extending budgetary requests of the organization Paytm Investors list took uncommon changes. Here we will cover the Paytm Shareholding pattern, Shareholders’ subtleties, and structure and answer every one of your questions. So, see below the Paytm shareholders.

History Of Paytm:

Vijay Shekhar Sharma is for sure a visionary. He considered something that was such an outsider idea to a large portion of us Indians in those days. In 2010, when credit only exchanges were just a removed idea, Paytm established its framework. At the outset years, the application was generally used to take care of tabs and energize mobiles.

It was after the achievement declaration of demonetization by the Prime Minister of India that Paytm had its huge break. Pretty much every Indian who has a cell phone had Paytm introduced in it. The online installments turned out to be so a lot simpler and Paytm likewise added significantly more alternatives to it, making it exceptionally simple to utilize. The organization has now developed to turn into the most trusted and widely utilized installment entry the country over. So, see below the Paytm shareholders.

Business Model Of Paytm:

Paytm prepared for other computerized installment sites that we see today in India. We can unhesitatingly say that this organization has made it simpler for different firms to begin their business in the business as they remain a model to gain from. Paytm originally took into account the necessities of the more youthful age and later extended its concentration to incorporate the more established populace of India.

The application gives the clients an e-wallet choice that empowers them to store some cash only for specific exchanges. Internet booking and reservation administrations are additionally given by Paytm. They work as an online commercial center that permits the clients to do their ordinary requirements easily. Paytm likewise is a virtual bank that is confirmed by the Reserve Bank of India. Everything is secret key ensured and profoundly secure.

The firm has likewise presented the idea of Digital Gold where the clients can purchase and sell gold on the web. They have an untouched working client assistance office that unravels any issues identified with the application immediately. Due to every one of these components, one can say that Paytm is one of the most secure online installment gateways accessible. So, see below the Paytm shareholders.

Paytm Company Growth:

With over 450 million enlisted uses and more than 200 million dynamic month to month clients, Paytm has come far. In 2010, the organization had a somewhat doubtful greeting as no one had confidence in credit only exchanges. It was simply after 2016 that the firm picked up acknowledgment and acknowledgment among people in general. Demonetisation gave Paytm the push it required.

The organization is an Indian unicorn that turned into the principal online installment application stage to cross 100 million downloads in the year 2017. They have presented a lot of clever thoughts from that point forward and have additionally augmented the extent of the application structure a simple installment stage.

The organization has seen outrageous development after somewhat of a stale period in the underlying time frame. “Paytm Karo” has become the trademark for each online exchange to be made. It has become an equivalent word for comfort and trust among clients over the globe. So, see below the Paytm shareholders.

Paytm Shareholders:

An Indian internet business installment framework and advanced wallet organization Paytm. Based out of NOIDA made the most out of demonetization following which the company is growing ever since. Paytm, claimed by One97 Communications, is a computerized installment stage that permits you to move money into the coordinated wallet by means of online banking, charge cards, and Mastercards, or even by saving money through select banks and accomplices. So, see below the Paytm shareholders.

One97:

Paytm is the consumer brand of India’s driving portable web company One97 Communications. One97 speculators include SAIF Partners, Intel Capital, and SAP Ventures.

One97 holds about 39% offers in the company which infers that SAIF Partners, Intel Capital, and SAP Ventures have their sequential offers in the organization. Generally, now One97 holds around 0.5% offer in Paytm.

Alibaba:

Alibaba, when put resources into Paytm, took around 25% share in the parent company One97 alongside taking some offer in Paytm. Accordingly, the MD of Tata Sons, Mr. Ratan Tata put resources into the organization.

Soft Bank:

After this expansion in Alibaba share rate in Paytm, Softbank (majority investor of best new businesses gave the organization including Alibaba) gave a huge $356 million for a stake of 4%-3% in Paytm.

Other Paytm Shareholders:

- Alongside that Capital, SVB (Saama Capital) and SAP Ventures used to have a consolidated stake of about 4.3% in the organization. Which at present has a place with Alibaba and Ant Financial. Later in March 2017, 47 employees Noida-based organization sold shares worth about Rs 100 crore when it Paytm was esteemed at $4.8 billion. Making millions like a flash and got their pockets loaded up with tremendous benefits.

- And speculations are that there will be an over half expansion in $10 billion valuations since it fund-raised from Berkshire Hathaway (BH International Holdings). The first venture by the Warren Buffet-claimed organization in a private innovation organization in the world.Following which the share percentage of Vijay Shekhar Sharma is around 13%-18%. Dismissing the offer in ONE97 which further has a portion of 39% in Paytm.

- So to tell in straightforward words and conclude, before the significant financing of Paytm by significantly Alibaba, SoftBank, and SAIF Partners the offer rate of Vijay Shekhar Sharma was 51%. After the Paytm fundings, it is at 14%-16% for the time being. To be exact the current shareholding of Mr. Vijay Shekhar Sharma is 90,51,624 offer or 15.71%.