MUMBAI (NewsRise) — Bharti Airtel, India’s largest mobile phone company, reported a quarterly net income that beat analysts’ expectations, helped by rising demand for mobile data services in the world’s fastest-growing telecom market.

Consolidated profit in the quarter ended in June fell nearly 31% to 14.62 billion rupees ($218 million), compared with 21.13 billion rupees a year earlier. Analysts had expected the company to report a profit of 11.59 billion rupees.

Bharti Airtel, backed by billionaire Sunil Bharti Mittal, said the latest quarter included a net charge of 9.46 billion rupees related to foreign currency regulatory changes in the Nigerian market. Consolidated sales grew 7.9% to 255.46 billion rupees. The company had nearly 358 million customers at the end of the quarter.

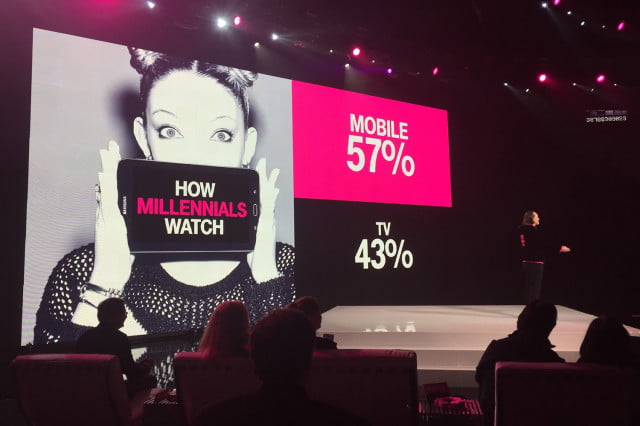

Bharti’s growth comes at a time when demand for mobile data services is set to grow at a fast clip in the south Asian nation that is home to more than a billion mobile phone users. Bharti and rivals have been expanding their high-speed mobile network coverage across the country, as they face impending competition from billionaire Mukesh Ambani’s Reliance Jio that is set to launch its services in the next few months.

Bharti has so far this year spent more than $1 billion to acquire airwaves from smaller rivals to take on Jio’s nationwide network footprint.

In the June quarter, the company’s mobile data revenue grew more than 35% to 35.25 billion rupees amid a spike in customer base and increased traffic. Mobile broadband customers increased more than 68% to 36.6 million from 21.7 million in the previous quarter, Bharti said. The latest quarter also saw a 28% jump in data usage by customers.

Earlier this month, the company slashed its pre-paid data tariffs in a bid to stimulate data consumption. Bharti said it will offer as much as 67% more data for the same fees. It last year pledged 600 billion rupees of investments to upgrade its infrastructure over three years.

Ratings company Fitch Ratings, which already has a negative outlook on the telecom sector for this year amid concerns of a cutthroat price war, expects service providers to effectively reduce tariffs by at least 15% to 20% in the next 12 months, the Economic Times reported on July 18.

Bharti said its net debt, barring payment liabilities and lease obligations stood at $6.89 billion, down 7.5% from $7.45 billion in the previous quarter.

Shares of the company ended 0.80% higher at 372.55 rupees in Mumbai trading, while the benchmark S&P BSE Sensex closed 0.17% higher.

[Source:- ASIAN REVIEW]